After tax profit margin calculator

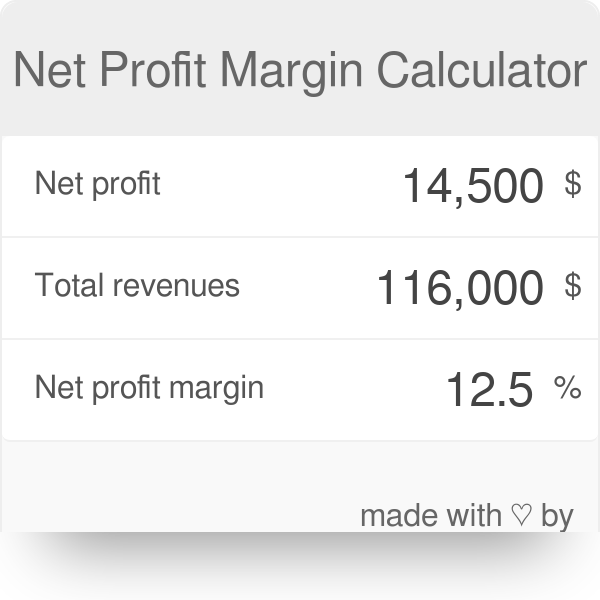

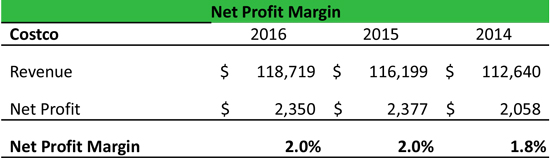

A companys net profit margin tells you how much after-tax profit the business keeps for every dollar it makes in sales. Rates subject to change.

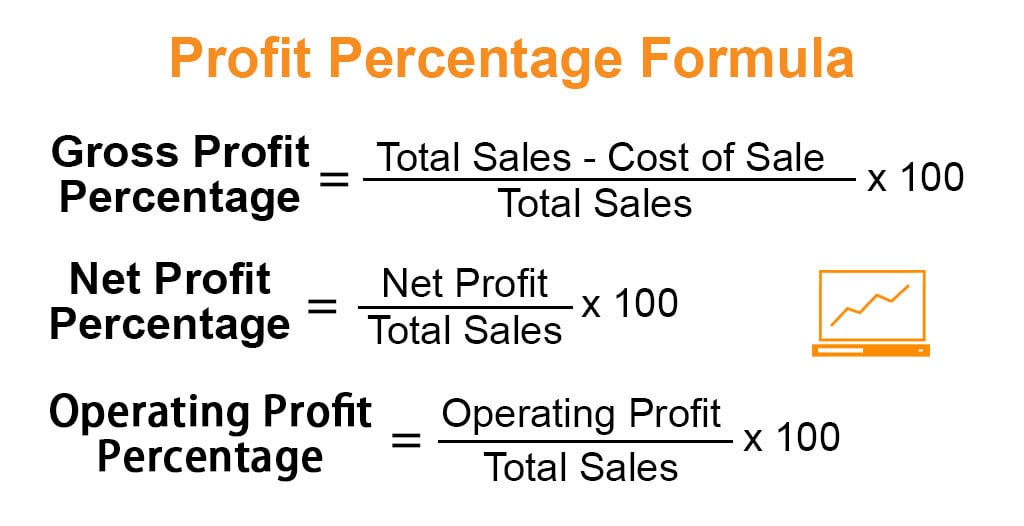

Profit Margin Formula Calculator Examples With Excel Template

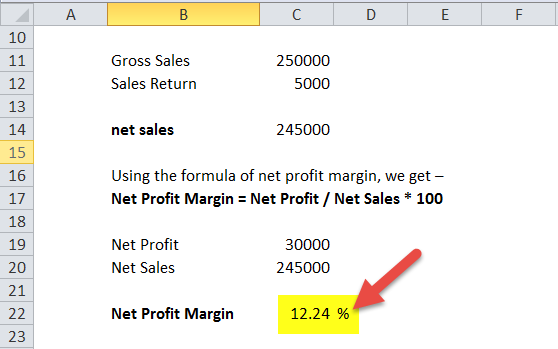

Net Profit Margin Net Profit Total revenue x 100 Net Profit Margin INR 30INR 500 x 100 Net Profit Margin 600 The company has.

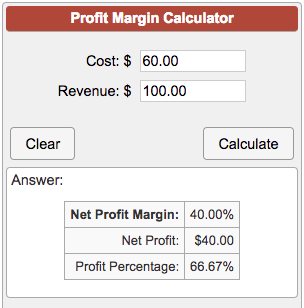

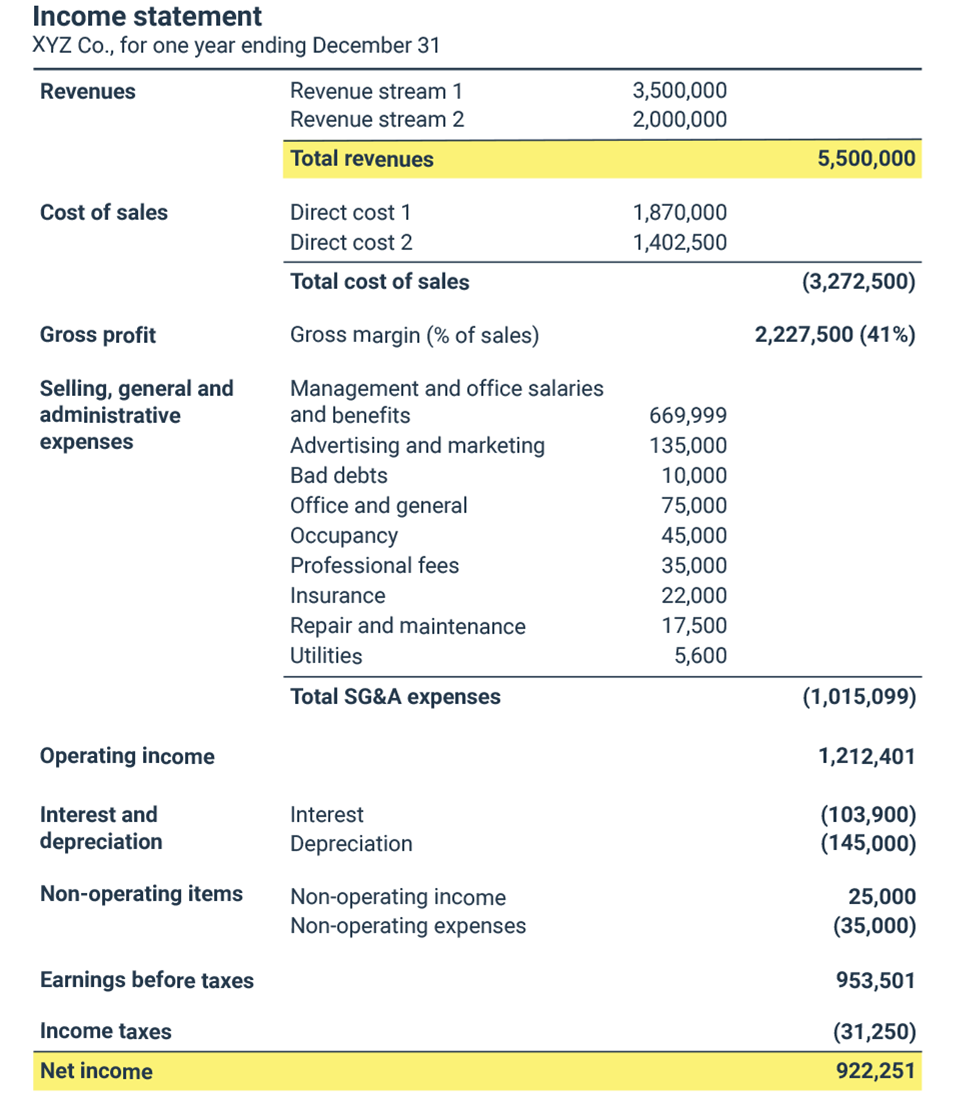

. The net profit margin calculation is simple. Calculation of net profit margins by using a formula. The after tax profit margin ratio expresses the companys net income or earnings as a percent of the companys net sales.

StockEdge gives us After Tax Profit Margin of the last five years of any company listed in the stock exchange. The ratio can be calculated using the following equation. You may link to this calculator from your website as long as you give proper.

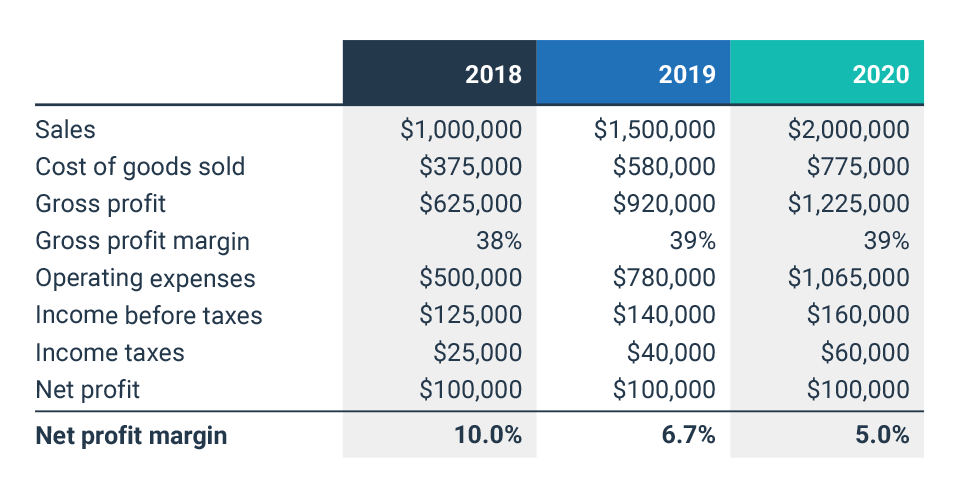

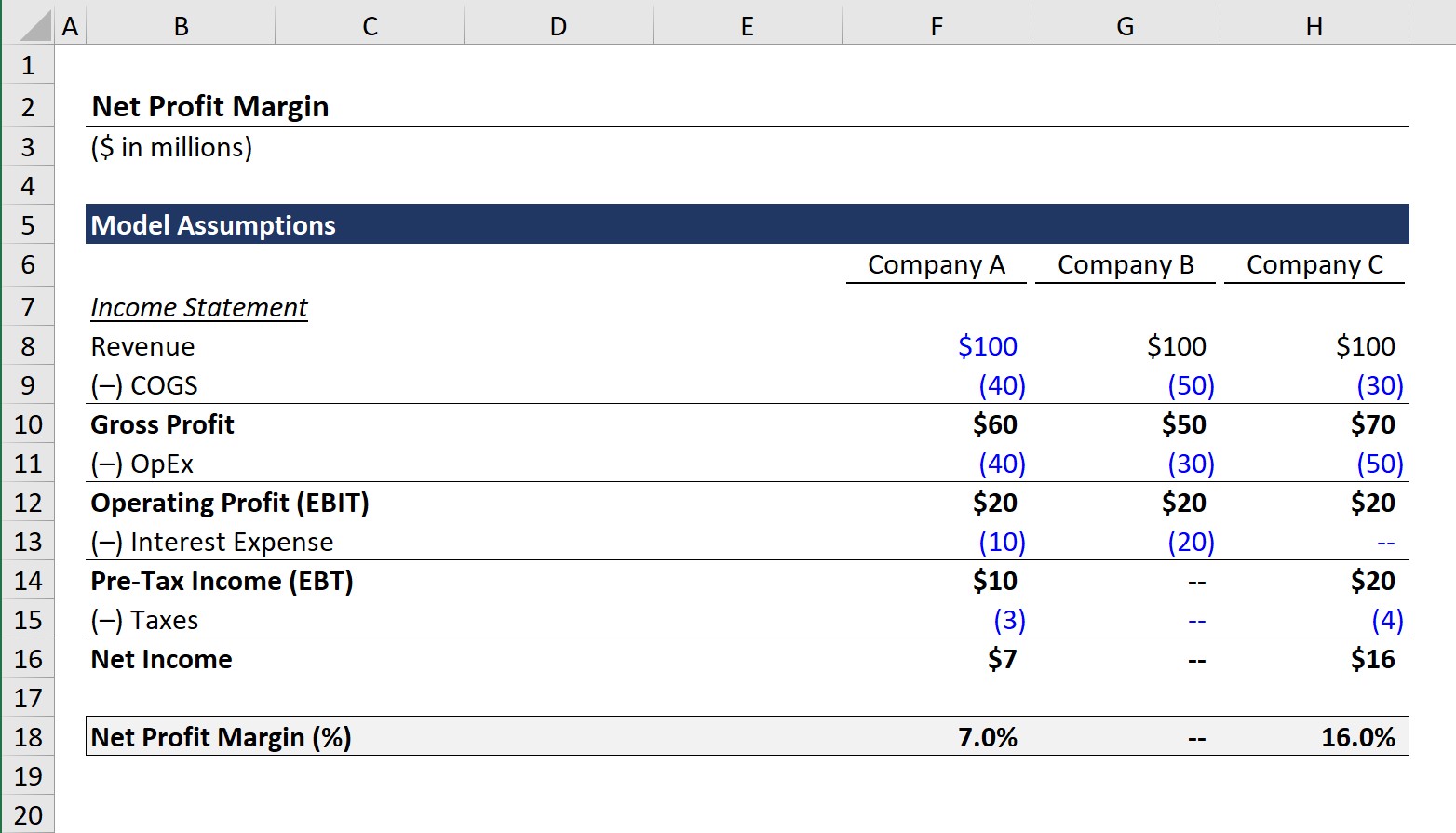

For example if your sales are 1 million and your net. Total Revenue Total ExpensesTotal Revenue Net ProfitTotal Revenue After-Tax Profit Margin By dividing net profit by total. This is an important basic measure since it informs investors how much money the company makes.

In situations when you have supplies falling under various tax brackets in a. Following are the additional details. Profit Margin Net Income Revenue 2 Lets say your net sales equal 50000 after all discounts and returns are accounted for and your businesss bottom line is equal to.

Its after-tax profit margin is 66 200000 300000. Margin rates as low as 283. Rates subject to change.

Earnings Before Taxes EBT Net Income Taxes EBT can sometimes be found on the income statement. We dont have to calculate After Tax Profit Margin on our own. The following year the companys net income increased to 300000 and its sales revenues increase to 500000.

Net profit after taxes is divided by total sales to calculate profit margin. Example of Profit After Tax. Taxes 21 Tax Rate 11 million Net Income 40 million The two inputs we need to calculate the pre-tax margin are the earnings before taxes EBT and the revenue for 2021.

The formula for after-tax profit margin is. To find the net profit margin take the after-tax net. This calculator has been designed for GST exclusive inputs.

Net Operating Profit after Tax Operating Profit 1 Tax Rate. About the Calculator. Complementarily in order to calculate the Profit Margins for your business we offer a calculator free of charge.

In other words the after tax profit margin ratio shows the. Suppose there is a company named ABC Inc. Profit Margin Calculator For GST-Exclusive inputs.

Whose total turnover during the previous financial year was 20000. Take your net income and divide it by sales or revenue sometimes called the top line. For calculating net operating profit after tax consider the following formula.

Margin rates as low as 283.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Net Profit Margin Calculator Bdc Ca

After Tax Profit Margin Definition And Meaning Market Business News

Profit Margin Calculator

Performance Profits How To Calculate Your Small Business S Margin Mila Lifestyle Accessories

Pretax Profit Margin Formula Meaning Example And Interpretation

Net Profit Margin Calculator

Net Profit Margin Formula And Ratio Calculator Excel Template

Net Profit Margin Formula Example Calculation

Profit Margin Formula And Ratio Calculator Excel Template

Net Profit Margin Calculator Bdc Ca

Net Profit Ratio Double Entry Bookkeeping

Profit Percentage Formula Examples With Excel Template

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Net Profit Margin Definition Formula How To Calculate

Net Profit Margin Formula And Ratio Calculator Excel Template

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ